Sometimes big changes occur so gradually we aren’t aware the changes are significant. Back in 2008, for example, IDC predicted the information technology industry was at the very

beginning of what IDC called a "hyper-disruption” of the business, something that happens "once every 20 years to 25 years."

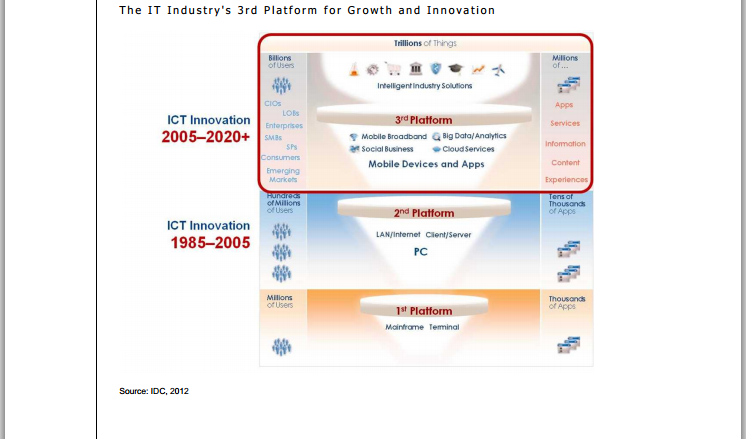

Simply, IDC predicted, rightly, a shift to computing built on mobile devices and apps,

cloud services, mobile broadband networks, big data analytics, and social technologies. That would supersede the current era, which many of us would have a hard time naming, though it is clear we had eras lead by mainframe, minicomputer and then PC devices.

More recently, the Internet has been a bigger factor, and mobile has clearly emerged as an important device form factor.

Collectively, IDC refers to this next era of computing as the "third platform." By about 2020,

when the information technology industry generates $5 trillion in spending, over $1.3 trillion

more than it does today, 40 percent of the industry's revenue and 98 percent of its

growth will be driven by third platform technologies that today represent just 22 percent of

spending.

It would be fair enough to note that such changes in computing eras had direct consequences for suppliers and buyers, notably the inability of any leader in one era to similarly dominate the next era, changes in sales channels (direct to indirect), end user devices, indoor networking and access networks and protocols.

Mobile and cloud are perhaps the easiest ways to characterize the direction of the shift. By extension, such periods of disruption also are going to disrupt revenue models and magnitudes for current suppliers.

A rational observer might agree that “consumerization” of information technology (people using consumer devices and apps) is characteristic of such a platform, as cloud services can be acquired and used by consumers (and also in their work roles) without distribution layers between end user and supplier.

Those distribution layers are important because they include significant businesses--telcos, cable companies, satellite providers, mobile service providers, ISPs, channel partners, distributors, value-added resellers and device suppliers.